Branch transformation — it’s how most financial institutions tackle the problem of declining branch traffic. They reason that making the branch more appealing, more comfortable, more automated, more trendy (i.e. less like a bank and more like a store), people will come back.

But this approach ignores a simple fact. People don’t visit a bank to shop, work or socialize. People visit a bank to, well, bank.

When the bank branch was the only way customers could service their checking and savings accounts, they had little choice about using a branch. So it’s logical that branch traffic is down simply because so many routine transactions can now be done online, through a mobile device or at an ATM.

Simply changing the look and feel of the branch isn’t going to increase branch traffic. Just because you build it, doesn’t mean they’ll come.

Financial institutions struggle to find ways to bring customers back into the branch. Inspired by design models used by successful retailers, banks have been incorporating patterns and design elements to make branches more appealing destinations. But does making a bank more like a coffee shop or popular retail store really bring in more customers? Banks need to evaluate which services still drive traffic to the branch. Only then can they can focus on making the branch the preferred channel to receive those services.

It’s time for a different approach

A step-by-step approach to physical and technical transformation provides flexibility and allows you to respond quickly in a dynamic and constantly changing environment. We call it an evolutionary approach because the change doesn’t happen overnight — it’s a process. Evolution is the gradual development from a simple to a more complex, improved form.

The process of evolution begins when external pressures demand a change. In order to survive, an organization adapts by making small, gradual changes. And the most advantageous changes; those that promote the greatest success are repeated and become part of the final makeup. This model applies extremely well to established organizations as a blueprint for how to implement change. This more natural way of adaptation increases the chance for a successful outcome.

An incremental approach puts customers, products, delivery and technology at the center of branch strategy. It provides freedom and flexibility to adjust the strategy, mid-course, if necessary.

Pattern Language

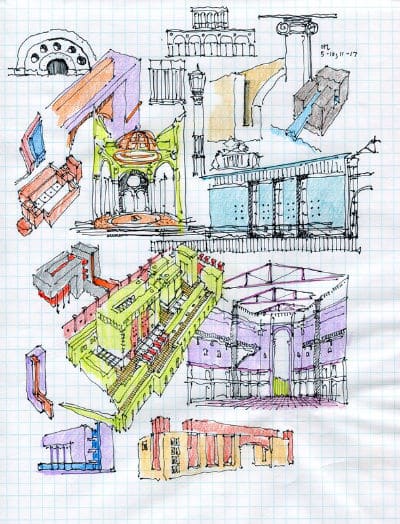

When we discuss a “pattern”, we are intentionally using language from The Pattern Language and A Timeless Way of Building, by Christopher Alexander. These architectural reference books describe a design language based on natural planning considerations. Patterns are the units of this language. Each pattern describes a design problem and solution including provisions for future modification and repair. This is consistent with the idea that the most satisfying spaces are those that tend to change and evolve over time.

At the core […] is the idea that people should design for themselves their own houses, streets and communities. This idea […] comes simply from the observation that most of the wonderful places of the world were not made by architects but by the people.— Christopher Alexander et al., A Pattern Language

There is a different approach to branch transformation — one where technology and strategy coexist. This gradual approach reduces your risk when industry trends inevitably shift. Most importantly, it doesn’t require you to plan the future based on today’s technology.Retail banking must identify and understand the patterns in a branch environment in order to apply these principles in a meaningful way. We need to discern these patterns and identify their key elements and commonalities.

Identified branch patterns include:

- Teller line

- Teller pod

- Universal Banker

- Shared transaction (teller and consumer)

- Customer-managed transaction

- Vault buy

- Commercial deposits

Each pattern is made up of a group of events. When you understand the events that occur during each type of transaction, you discern the pattern. This includes considering things like requirements for privacy and the technology elements associated with each pattern.

Adaptable technology elements allow for a modular transformation. Making small, incremental changes to process of processes allows the opportunity to understand the impact of each change on your branch staff, the customer and operational processes. This way there is the flexibility to make adjustments and adapt gradually to the changes.

In an age of constant change, organizations are pressured to change fast and often. Financial institutions are no exception. But constant change is exhausting and change without strategy is inefficient. Technology often drives change but it shouldn’t dictate strategy.

Not when there’s a better way.