It’s a crime story staple: at the pinnacle of the criminal enterprise, show us the money. In Breaking Bad, the audience is treated to an escalating series of spectacles as the characters devise new ways to manage their growing cash supply. In Ocean’s Eleven, everything builds to the famous vault scene. In Blow, a tracking shot weaves from room to room behind Johnny Depp as he passes through narrow walkways between stacked cardboard boxes filled with cash; his character’s home is so full of money that it would fit in an episode of Hoarders.

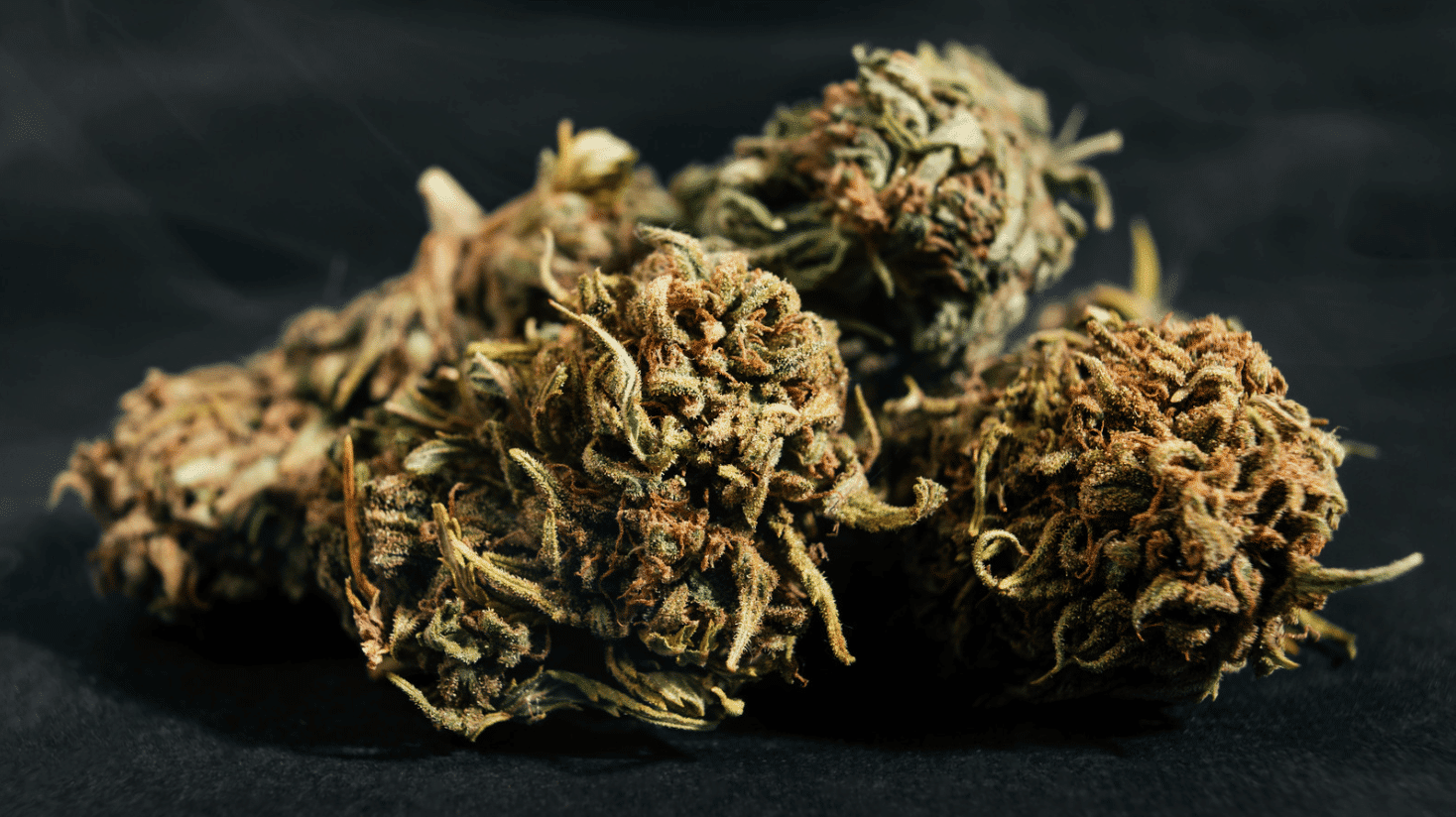

The too-much-cash-to-launder problem stems from the fact that the money in these stories is obtained illegally; legal businesses just take their money to a bank. However, the budding legal marijuana industry in Colorado, Washington, and other states is putting this notion to the test, and the result is widespread cash management problems for cannabis entrepreneurs that have led to reports of Chipotle bags filled with cash and holding companies designed to hide the true nature of businesses.

Colorado’s legal pot shops are a great case study, but the challenge is the same in any state that decides to legalize marijuana. Marijuana stores opened in Colorado on January 1 of this year, operating legally under state laws built on the foundation of a 2012 amendment to the state constitution that legalized the substance. Despite the stores’ legality under state law, federal law has not changed, and marijuana remains a Schedule 1 controlled substance under the Controlled Substances Act.

Marijuana’s status as a Schedule 1 controlled substance is at the core of a big problem for the industry. Schedule 1 substances are the most strictly regulated under federal law, and the Controlled Substances Act, together with other federal law, prohibits certain industries from working with cannabusiness. The banking industry is among those most affected.

As it stands, the banks are wary of working with marijuana businesses for fear of federal prosecution; issuing accounts, accepting deposits, and providing credit card services could all qualify as criminal under federal law, according to experts. These rules have led to strange situations, from cash-only retail outlets growing large cash stockpiles to entrepreneurs spraying money with Febreze in an effort to mask its source.

On Valentine’s Day, the Treasury Department and Justice Department issued separate advisories intended to assuage the fears of banks and allow state-authorized marijuana businesses to have access to banking services. The reaction of bankers was not reassurance, but rather continued discomfort with the situation, both because of ongoing vagueness in the rules and because of the daunting compliance requirements if banks do decide to work with legal marijuana.

The complexities of the situation—combined with high demand for the product—mean that this will be a situation worth watching for those in the cash and banking industries. As the marijuana business expands in Colorado, takes root in Washington, and possibly expands to other states, something will have to give. If not, the marijuana magnates are going to have a lot of green on their hands.