The Washington Trust Story

Washington Trust Bank didn’t become the oldest and largest commercial, privately-owned bank in the Pacific Northwest without already knowing the value of delivering exceptional service.

So it came as no surprise when the bank decided to make changes that would help them take their customer service to another level.

To accomplish this, the bank had to solve problems facing many financial institutions and businesses today.

The Challenge

Old ways were getting in the way of better customer service.

How do you perform error-free, cash counting processes AND pay attention to your customers at the same time? Each role is important and both have negative consequences if not performed properly. Out-of-balance drawers can result in out-of-work tellers and not paying attention to customers has helped turn Quicken Loans into the nation’s largest residential mortgage lender.

Washington Trust Bank realized juggling cash and customer service was counter-productive. “When you have a cash drawer, that’s really all you’re thinking about,” said Cathie Winegar, Vice President, Retail Operations Manager. “You’re focusing on maintaining the security of that cash, and you’re really not having your full focus on the customer interaction.”

“One of my biggest pet peeves was watching a teller pretend to have a conversation with a customer while counting their money.”

Jake McCarty, Vice President, Retail Group Operations Manager

That lack of focus was limiting Washington Trust, causing them to miss opportunities to provide services for their customers. “One of my biggest pet-peeves was watching a teller pretend to hold a conversation with a customer while they counting their money,” said Jake McCarty, Vice President, Retail Group Operations Manager. “Oh, I’m glad you had a fun vacation. Just a second while I ignore you counting this money.”

Finding staff who could count cash and be good at sales was also a problem. “We’d go out and find good sales people, good people people, and they couldn’t balance very well,” said Jim Branson, Senior Vice President, Director of Retail Banking. “So we began thinking should we be hiring and then firing because they can’t balance or is there a solution out there that we can bring in-house to do away with most of the balancing issues and allow the good sales people to take care of our customers?”

The Solution

Break up the teller line, open up the branch, & create barrier-free transaction areas.

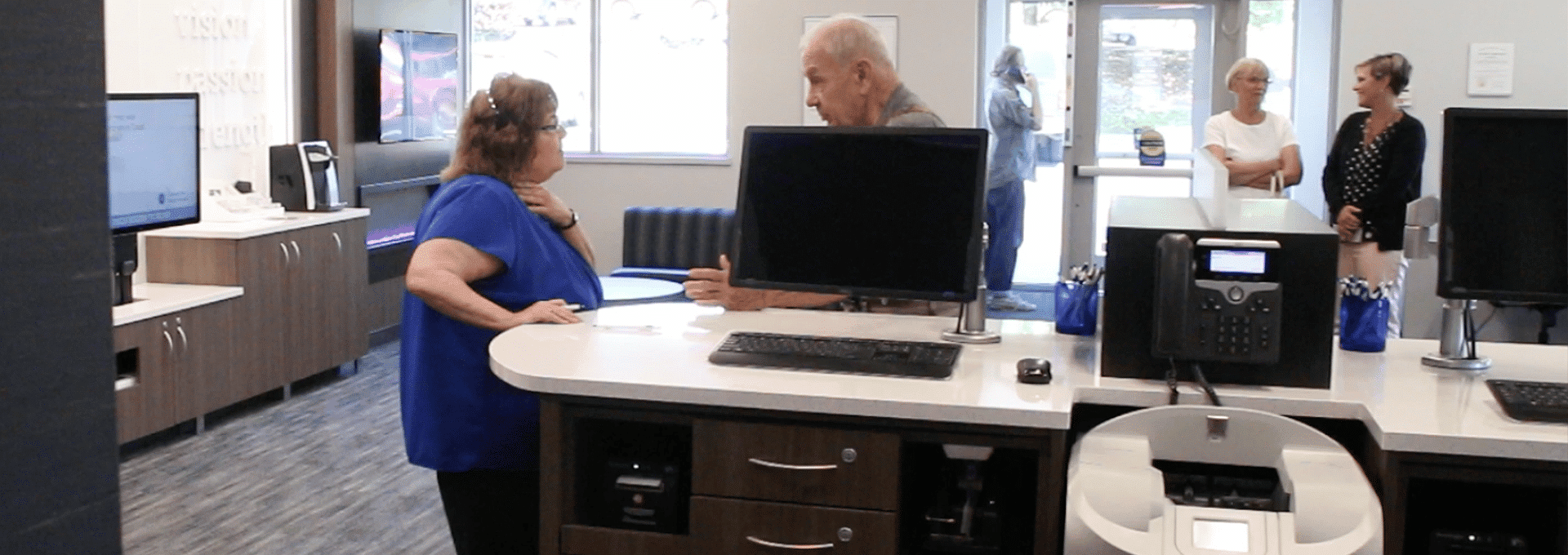

Washington Trust Bank wanted to make their branches more open so staff could better serve customers.

The first step was to eliminate the biggest obstacle standing between them—the traditional teller line. “We got rid of those teller lines, that great wall that separated us from the customer,” said McCarty.

The huge counters were replaced with several smaller and more private transaction areas equipped with cash recyclers designed specifically to accommodate the amount of traffic each workstation would experience.

“Cash recyclers allowed us to break the teller line into pieces and pods,” said McCarty. “The majority of our transactions are at stand-up workstations and the tall recyclers, the CM18s and the Evos, work really well. And the sit-down model, the Solo, allows us to put it at a desk, which is great because that works for any type of transaction and that person can also help out during high traffic periods.”

Arca cash recyclers allowed the elimination of cash drawers and provided the security necessary to create the open branch environment. “The cash is all locked up in a machine,” says Kelly Kinzel, Branch Manager and Regional Sales Team Lead. “So we don’t need to worry did somebody accidentally leave a drawer unlocked, or is a customer able in this open environment able to walk over to a drawer and take money out. It’s all secured in a safe.”

“Anybody at a desk or at a pod is able to help customers with whatever it is that they need.” “Now, instead of having to pass them off to somebody else, you’re just a one-stop shop.”

Tami Ferguson, Retail Group Manager

The next step toward better service was to train everyone to do everything. Tellers were taught how to create new accounts and provide loans. “We went to a Financial Concierge model,” said Tami Ferguson, Retail Group Manager. “Anybody at a desk or at a pod is able to help customers with whatever it is that they need. Now, instead of having to pass them off to somebody else, you’re just a one-stop shop.”

Branch managers and assistant managers were next at Washington Trust. Their offices were closed and they were moved out into the branch, seated at open desks. “That’s been really great, bringing us out in direct contact with our customers all day long,” said Tracey St. Onge, Branch Manager and System Vice President. “Now we are front and center. And we’re able to jump in if employees need help or coaching.”

The Results

Happy customers have resulted in an increase in sales for Washington Trust.

The new layout has created freedom within the branch that has fostered successful relationship banking experiences. “Customers can actually flow throughout the entire branch,” said Mollie Treppiedi, Assistant Branch Manager. “We have some customers who park, come into the branch and walk back to the drive through because they want assistance from an employee they have a relationship with.”

Happy customers have resulted in an increase in sales for Washington Trust. But the bank’s customer service philosophy isn’t based on high-pressure sales tactics.

“Cash recyclers have definitely had a positive influence on sales.”

Jim Branson, Senior Vice President, Director of Retail Banking

“Cash recyclers have definitely had a positive influence on sales,” said Branson. “Instead of having one person standing behind the teller line, we have five or six employees that are able to sell at all times. We’re definitely a bigger sales force than we ever were before. But we train everybody to treat customers like they’re your mom or dad, take the time to ask the questions to make sure you uncover what they really need, instead of just trying to sell them something.”

When customers walk into Washington Trust they are often greeted by their first name. The atmosphere is accommodating and the variety of cash recyclers help make that possible. “We do have some customers that we know prefer to sit down with somebody versus standing at the pod location,” said Treppiedi. “And some customers would rather be able to stand right next to the employee at the pod location. We’re prepared to handle any preference.”

“Customer service is all about taking care of the customer that’s in front of you,” said Branch Manager and Regional Sales Team Lead, Emily Burgess. “We want to make that experience something that they walk out and go, ‘Wow, I can’t believe that just happened and I can’t wait to go back.'”

“We want to take care of them here so they don’t have to go anywhere else,” said Assistant Branch Manager Christina Psomas. “The cash recyclers create time for us to look at their customer profiles and have conversations to uncover their needs.”

The positive changes at Washington Trust Bank branches have been replicated throughout their branch network. The Arca cash recyclers have allowed the bank to eliminate the physical obstacles to better customer service and let them replace inefficient processes with helpful, meaningful conversations.

“Out of our 42 branches, we currently have recyclers in 35 and plan on deploying recyclers to the remainder over the next two years.”

Jake McCarty, Vice President, Retail Group Operations Manager

“We felt like there was enough need and justification for the interaction with the customer and allowing those employees to focus on the customer interaction, said McCarty. “And so out of our 42 branches, we currently have recyclers in 35 and plan on deploying recyclers to the remainder over the next two years. We hear quite often from staff over a couple of weeks of having the recycler by their side, ‘If you take this thing away from me, I’m quitting,” said McCarty.

Arca cash recyclers have streamlined operations, made time for relationship banking and created new transaction areas within the branch. These significant outcomes have resulted in Washington Trust Bank being able to meet their customers’ financial needs and discover additional ones. All this while increasing revenue and delivering the best service possible in their branches.