Cash Environments

Environment is generally defined as “the surroundings or conditions in which a person, animal or plant lives or operates or where a particular activity is carried out.”

We use the term cash environment to describe the distinct settings within a bank or credit union branch where cash transactions take place. Each transaction area has unique patterns and requirements for privacy, accessibility, cash volumes and other factors.

When you look closely at the typical transaction areas in a branch, you can see how each one is set up to meet the particular needs of the transaction being carried out there.

What do cash environments have to do with cash automation?

Cash automation devices, like teller cash recyclers, automate manual cash handling for tellers. By removing the distraction of counting and sorting bills, cash recyclers create a window of opportunity for tellers to really engage with customers during transactions.

So, it makes sense that the more cash environments in a branch with cash automation devices, the more productive, efficient and profitable the branch can be. In other words, the wrong cash recycler can prevent you from realizing the full benefit of automating that cash environment. Take a look at these typical cash environments to see what we mean:

Teller Line

Customers use traditional teller lines to make deposits, cash checks and other routine cash transactions. Behind a teller line, cash recyclers can completely replace cash drawers so every cash transaction is automated. But to truly benefit the teller line, TCRs should store enough cash inventory to meet the cash inventory needs of daily teller activity and physically fit into teller workstations so they’re easy to access.

Most TCRs are designed for two operators and are typically shared between two tellers who alternate transactions on the device. But a single-user cash recycler can be extremely efficient at the teller line since tellers don’t have to alternate transactions. A combination of single and dual user TCRs can optimize every teller line configuration, even an odd number of tellers.

Retrofit solutions are ideal for quickly automating the teller line without the hassle or expense of modifications to existing teller counters. These devices can replace under-counter steel between two tellers without even affecting returns.

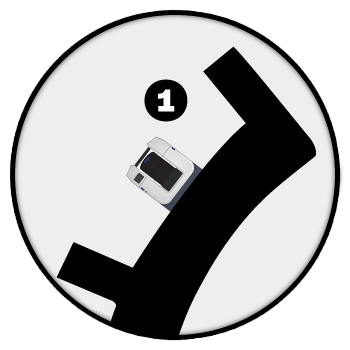

Teller Pods

An open concept take on the teller line, teller pods are found in modern branch designs. These free-standing workstations can be staffed by two tellers, sharing a dual user TCR between them or be configured as a privacy pod with a single-user device.

Teller cash recyclers provide the security and controlled access required to operate with cash in this type of cash environment. Teller pods literally remove barriers between tellers and customers and encourage relationship banking.

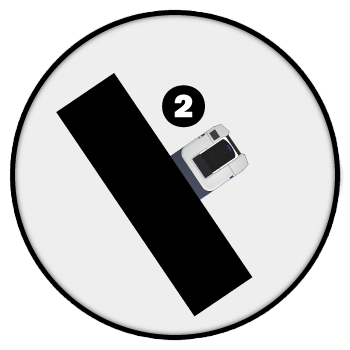

Drive-thru

Drive-thru activity and volume can vary significantly from branch to branch. The requirements for this environment depend on volume and workflow for a particular branch. But, in general, one teller serves drive-thru customers and may also assist customers in the teller line when needed.

A high-capacity, single-user cash recycler can allow the teller to serve customers quickly without having to alternate transactions with another teller to keep traffic moving, increasing efficiency and improving the customer experience.

Commercial/Merchant Window

A commercial/merchant window that processes large cash transactions from retail businesses can get backed up quickly. If a recycler is being shared between two tellers at a merchant window, one teller line is held up waiting for the other teller to process the transaction. If there isn’t a dedicated window for commercial deposits, the wait impacts the entire teller line.

This particular cash environment can have wide range of capacity requirements that need to be considered for each branch. In a branch with exceptionally high commercial deposits, a high-volume, large capacity TCR will allow faster processing of these transactions. Or even a single-user TCR with appropriate storage capacity at the merchant window maximizes efficiency and prevents waiting times caused when tellers have to alternate transactions.

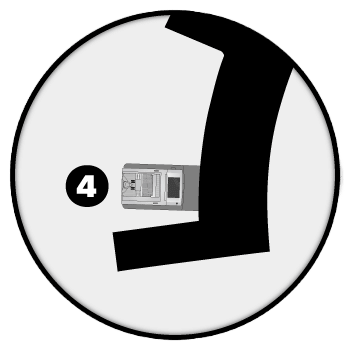

Interim/Day Vault

Vault transactions are a critical part of daily branch activity. But vault buys and sells are low-value transactions that consume the most valuable staff resources.

A head teller or manager must be the second control for every vault transaction. That’s two employees to stock every cash drawer at the beginning of the day, to buy cash from the vault during the day and for every vault sell to manage drawer limits during the day and at the end of the day. Because cash is so exposed during these transactions, this environment must be in a secured area, usually behind the teller counter.

But using a high-capacity teller cash recycler in a shared vault workstation:

- Allows tellers to manage their own vault transactions. With a complete digital audit trail, TCR can act as the second control.

- Frees head tellers from mundane vault transactions and allows them to assist customers and tellers.

- Reduces management staffing requirements at start and close of day and during weekend hours.

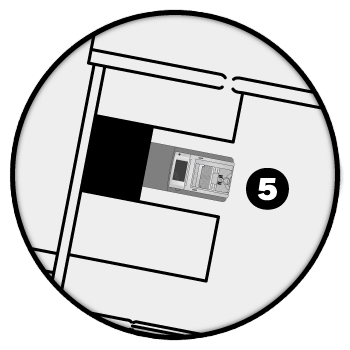

Universal Bankers and Customer Service at Desks or in Offices

Customers visit these specialized cash environments for activities that can’t be completed at the teller counter such as opening new accounts, applying for loans or advisory services. That makes these cash environments more sales-focused. Traditionally, though, these areas have been limited to non-cash transactions.

But having single-user teller cash recyclers at desks or in offices benefits your customers, staff and branch. Using secure cash automation as part of these sales-oriented environments allows staff to:

- Complete all of a customer’s transactions in one place.

- Relieve busy line tellers by pulling customers out of line to take care of their transaction while increasing their face time with your valuable sales-oriented associates.

- Engage customers in a more private setting that creates the opportunity for conversations that help help staff identify potential account needs and opportunities.

For these cash environments, a single-user TCR is the perfect solution to meet the privacy requirements while fitting discreetly into sitting or standing workstations.

Maximize the benefits

The goal of automating cash handling activities is to shift your staff from being focused on transactions to being focused on the customer and the opportunity they have with the customer in front of them. Every branch cash environment can benefit from cash automation but not every cash automation device is an ideal fit for every cash environment. Using TCRs in sales environments promotes relationships and revenue while having TCRs in high-traffic areas increases efficiency and costs savings. Using a right size, right fit approach to finding the best recycler for each cash environment helps branches automate every transaction and get the maximum benefit from cash automation.